- About Us

-

Smart Solutions

- By Industry

- By Application

- By Products

- Smart Services

- Case Studies

- FAQ's

- Contact Us

They were, at one time, two separate retail tracks – merchandising (Make money) and loss prevention (Save money).

There were store detectives to catch shoplifters and reduce shrinkage. And then there were mystery shoppers and people counters, most often clicking each shopper at a retailer’s entrance.

It is not surprising that retailers have caught on that the more they know about their shoppers, the more sales they have. And more sales can translate into profits and a stable or even growing business.

Then in the 1960s and through a pioneering electronic technology loss prevention offering, enter the “Shopper’s Enemy,” electronic article surveillance (EAS) and tags, introduced by Sensormatic, now part of Tyco Retail Solutions. At the time, the loss prevention focus was on shoplifters, still a key source of shrinkage. But over time, merchandisers continue to shop for ways to gain even more information about customers and staff members. It was big data before there was big data.

Security video arrived to replace, to some degree, those store detectives; cameras are a deterrent, able to catch shoplifters or rogue sales associates while providing damning forensics evidence at the after-event end.

Now, the two tracks – loss prevention and merchandising – are melding into one at prominent stores, chains and malls as retailers see value in data mining images collected by security video. There are even some retailers who have built video-based data collection systems separate from security; not many of this route, of course, since such action would cost more money and piggybacking made more sense. While not everyone’s cup of tea, the evolution has been spurred in great part by online shopping, which automatically collects customer data and demographics, as well as web page views that do not lead to a sale. Third-party retail firms, able to focus exclusively on analytics, also are encouraging the entrance of security video as part of a more total picture.

Uniquely, security video can complement other retail – non-pictorial – analytics going beyond the numbers by showing visually customers’ interaction and behaviors in a store.

The bottom line is the bottom line. While loss prevention has always made a case for saving money by diminishing illegal or unintentional losses from shoppers, sales associates and contractors, new-age analytics that includes security video can also generate an increase in sales as well as better product placement and store layout.

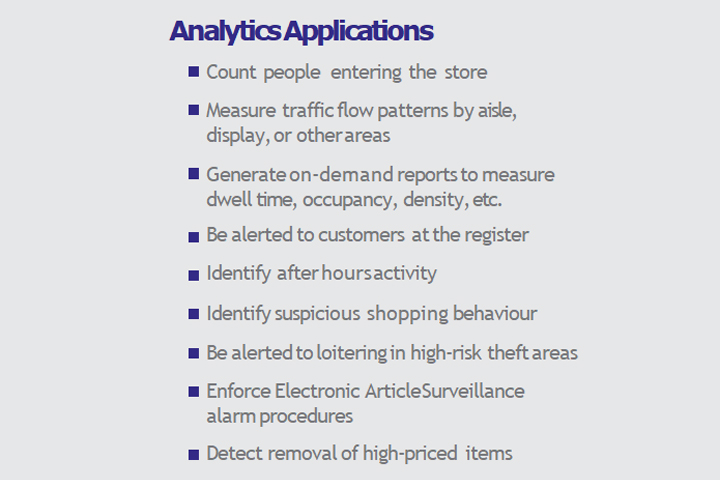

Security video as well as other retail analytics can: